Ah yes, the sweet irony of markets doing what markets do best: Humbling billion-dollar empires at the worst possible moment.

Shares of DraftKings and Flutter Entertainment (parent company of FanDuel) have been hit hard after whispers grew louder that traditional sportsbooks are losing ground to prediction markets. Nothing rattles Wall Street quite like the idea that its favorite gambling cash machines might be getting disrupted by nerds trading sports outcomes like futures contracts.

Call it a fumble. Or better yet, call it a blindside hit.

The Stock Plunge: A Hail Mary Gone Wrong

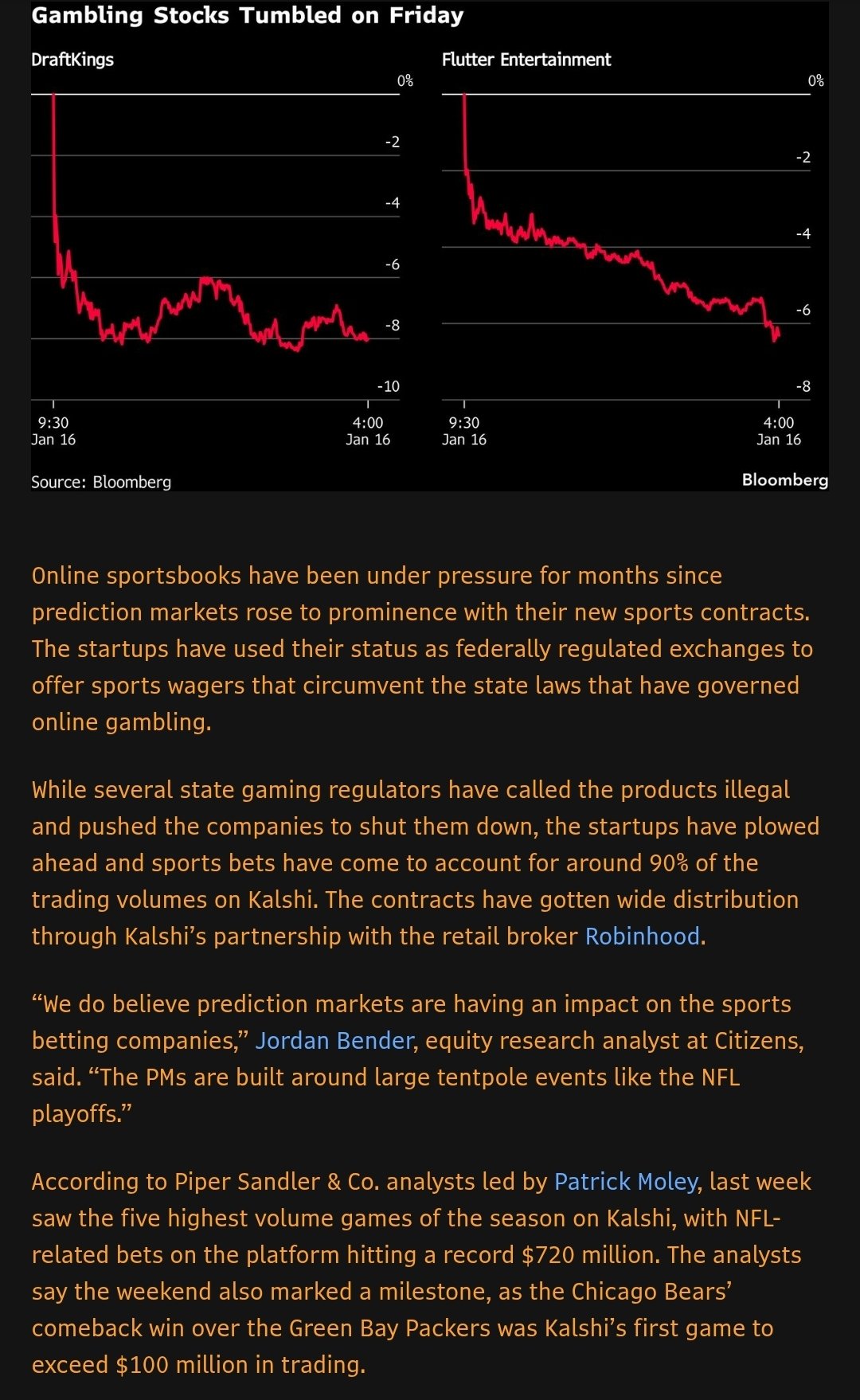

According to Bloomberg, new data dropped last Friday showing sportsbooks ceding ground to prediction market platforms like Kalshi and Polymarket.

The reaction was immediate and ugly.

DraftKings shares sank roughly 8% in New York trading, their worst one-day loss since September. Flutter wasn’t spared either, sliding more than 6% to its lowest level since August 2024. The broader S&P gambling index dipped about 2%, proving once again that misery loves company.

Adding fuel to the fire, New York state data showed online sports betting revenue falling sharply year over year. Translation: the boom-time bonanza may finally be wobbling. And Wall Street does not do wobble.

Rise of the Underdogs: Prediction Markets on the March

Prediction markets aren’t your grandfather’s sportsbook. These platforms offer financial contracts tied directly to outcomes, essentially letting users trade probabilities rather than bet into fixed odds with baked-in vig.

And during the NFL playoffs, they’ve been booming.

Sports-related contracts now account for roughly 90% of trading volume on Kalshi, and anecdotal data suggests engagement spikes whenever the sports calendar heats up. For legacy sportsbooks built on hold percentages and parlay juice, that’s an uncomfortable trend.

Some analysts argue that prediction markets aren’t just growing, they’re actively siphoning off high-value bettors. That’s not disruption. That’s a linebacker sprinting downhill untouched.

Skeptical Sidelines: Not Everyone’s Buying the Hype

Still, not everyone thinks this sell-off is the sportsbook apocalypse.

One junk-bond trader turned betting analyst noted he’s not hearing much disruption offshore or in massive unregulated states like California, Texas, and Georgia. His benchmark is blunt: if prediction markets cause a 50% handle drop in year one, then we’ll talk. Until then, skepticism remains warranted.

He also points out a less sexy, but more likely culprit: hold volatility.

Weekly hold data has been erratic, and sportsbook equity models are hypersensitive to even small deviations. A bad hold week can spook investors fast, regardless of long-term fundamentals. Prediction markets may be a threat eventually, but pinning this entire sell-off on them alone? That’s a stretch.

That sentiment was echoed by traders who reminded everyone that revenue ≠ handle. Bettors winning for a week doesn’t mean the business is broken; it just means variance showed up uninvited.

The Sarcastic Kicker: Overreaction or Omen?

So what really happened here?

The cleanest explanation is the market overreacted to weak New York hold data, confused short-term revenue noise with long-term structural decline, and panic-sold first, asking questions later.

Some optimists even argue prediction markets could help sportsbooks long-term by expanding the overall betting ecosystem. Bullish by year-end, they say.

Sure. And your fantasy team is still alive, too.

Reality check…most bettors still don’t know what a prediction market is. Sportsbooks remain the Bud Light of betting: ubiquitous, familiar, and easy. Prediction markets are more like craft beer: niche, growing, and quietly siphoning off the most engaged users.

But the direction is clear:

- Lower fees.

- Better pricing.

- No vig disguised as “innovation.”

Either sportsbooks adapt, or they keep bleeding their sharpest customers to platforms that treat betting like trading instead of a tax.

The underdogs have drawn blood. Whether the giants rally or keep slipping is the next bet worth watching.

And this time, the odds might not come from a sportsbook.