A significant development is underway in the prediction markets on Polymarket. While traditional news headlines catch up, the “wisdom of the crowd”, backed by millions of dollars in volume, is rapidly pricing in a series of cascading events involving Iran.

We are looking at three distinct markets that, when viewed together, tell a singular, volatile story: Intervention, Destabilization, and Collapse.

Here is the breakdown of the data signaling a potential geopolitical earthquake before the end of Q1 2026.

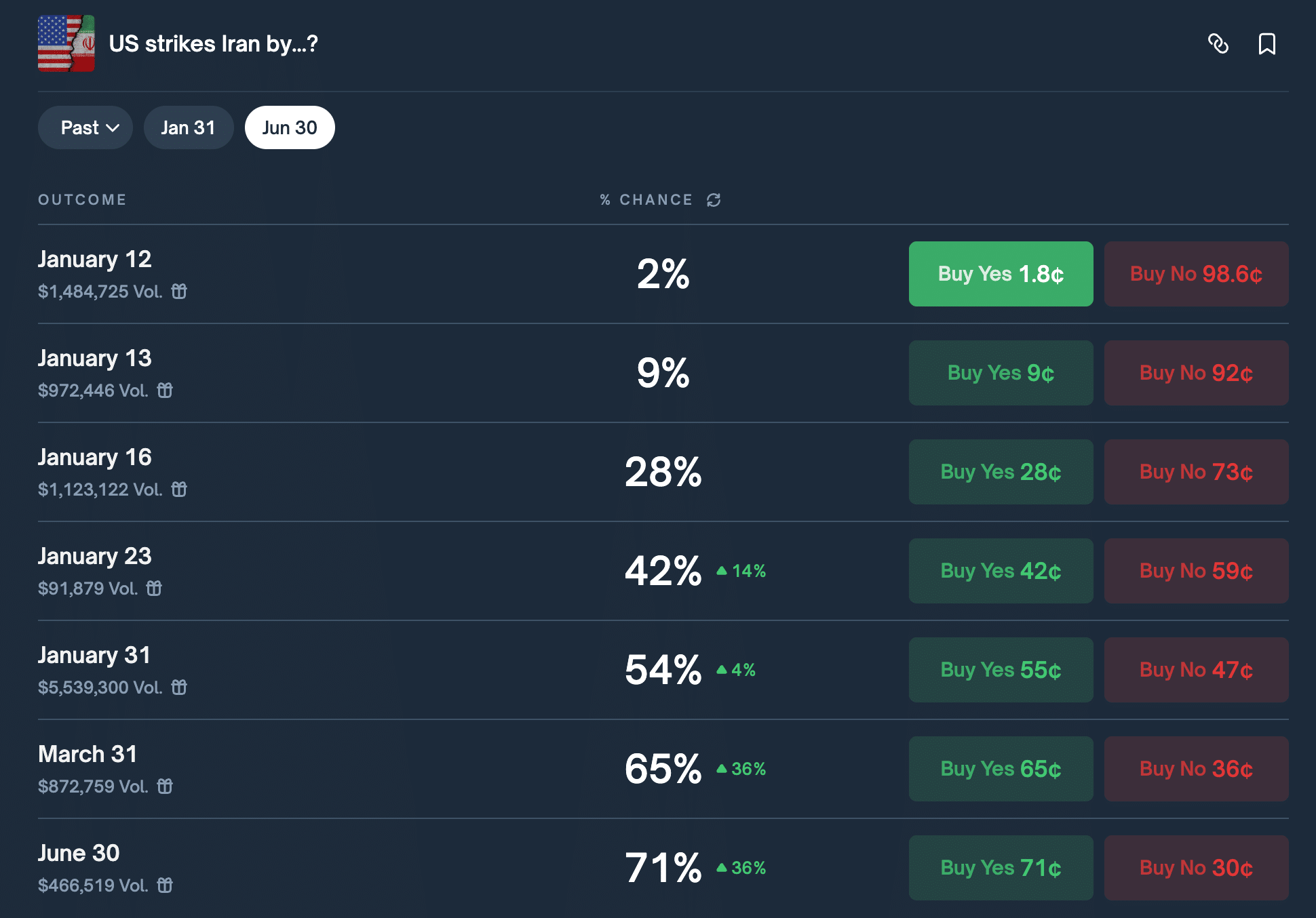

1. The Trigger: A US Strike Becomes the Base Case

Market: US strikes Iran by…?

The most immediate signal is the probability of kinetic action.

- The Shift: Just days ago, a US strike was a minority possibility. Today, the market has flipped.

- The Data:

- January 31 Contract: Traders are now pricing a 54% chance of a US strike occurring before the end of this month.

- Short-Term Velocity: The probability jumps from 9% (Jan 13) to 28% (Jan 16) in just a 72-hour window.

- High Conviction: The January 31 contract alone has over $5.5M in volume, suggesting this isn’t just retail noise, this is heavy capital positioning for an imminent event.

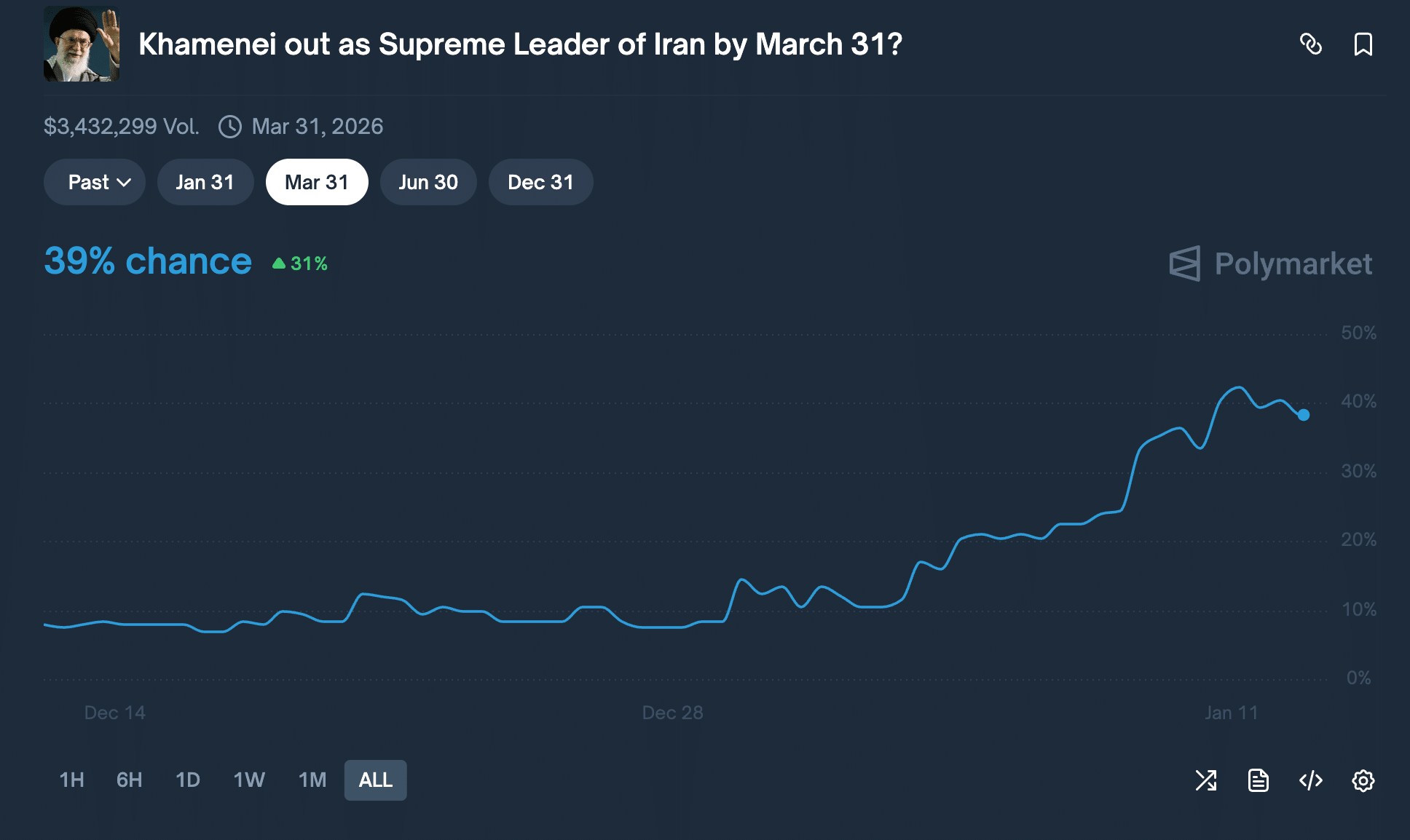

2. The Leadership Crisis: Khamenei’s Grip Loosens

Market: Khamenei out as Supreme Leader of Iran by March 31?

Correlating with the strike probability is a massive spike in bets against Supreme Leader Ali Khamenei’s tenure.

- The Surge: This market is up 31% recently, sitting at a 39% probability.

- The Timing: The “Yes” outcome aligns almost perfectly with the post-strike timeline (February/March). The graph shows a vertical ascent starting in late December, indicating that traders view his removal not as a vague long-term risk, but as a near-term consequence of the escalating conflict.

3. The Endgame: Regime Collapse

Market: Will the Iranian regime fall before 2027?

Perhaps the most startling chart is the long-term view.

- The Odds: There is now a 45% chance priced in that the Islamic Republic itself will fall within the next 12 months.

- The Trend: This market is up 30%, mirroring the Khamenei chart.

- The Implication: The market is effectively saying that if the strike happens (Market 1) and Khamenei is removed (Market 2), the structure of the regime is unlikely to survive the vacuum (Market 3).

Summary of the “Iran Trade” on Polymarket

The prediction markets are weaving a clear causal narrative:

- Imminent Action: A US strike is now favored (>50%) to happen by Jan 31.

- Political Shock: This action is expected to severely destabilize the Supreme Leader’s position by March 31.

- Systemic Failure: The resulting instability creates a nearly coin-flip probability (45%) of total regime collapse within the year.

Disclaimer: Prediction markets reflect the weighted consensus of traders and probabilities, not guarantees. However, with over $10M in combined volume across these specific outcomes, the “smart money” is shouting that the status quo is about to break.