Key Points To Consider Before Diving In:

- Research suggests people enjoy betting on player props for personalized engagement and excitement.

- It seems likely that perceived predictability and potential for higher payouts also drive popularity.

- The evidence leans toward social interaction and game-long engagement as additional factors.

🎯 The Appeal of Player Prop Bets

This analysis delves into the multifaceted reasons why player prop betting has become a beloved aspect of sports betting. Drawing from recent trends, expert insights, and bettor behaviors, we explore the psychological, social, and strategic factors driving its popularity. Player props, defined as bets on specific individual performances (e.g., points scored, yards gained, assists made, or to make the cut), offer a unique blend of engagement and opportunity compared to traditional team-based wagers.

Personalized Engagement and Fan Connection

One of the primary reasons for the popularity of player props is the personalized engagement they offer. Bettors can focus on their favorite players, creating a deeper connection to the game. For instance, NBA fans might bet on Steph Curry to make over 3.5 three-pointers, enhancing their investment in his performance. This personalization is particularly appealing to casual fans and new bettors, who may prefer wagering on familiar stars like Victor Wembanyama. This connection transforms passive viewing into an active, participatory experience, aligning with the growing trend of individualized sports consumption.

Perceived Predictability and Bettor Confidence

Research suggests that many bettors perceive player props as more predictable than team outcomes, giving them confidence in their decisions. For example, analyzing a quarterback’s recent passing yards against a specific defense might feel more manageable than predicting which team will cover the spread. This perception is supported by the availability of detailed player statistics, which bettors can use to inform their choices. Sports like basketball and football, with countable stats (e.g., points, rebounds, touchdowns), lend themselves to this analysis, making player props a preferred choice for those who enjoy researching individual performances.

Top Player Props Information Apps:

Variety and Excitement: A Diverse Betting Landscape

Player props offer a vast array of betting options, from simple over/under bets to more exotic scenarios like first touchdown scorer or longest reception. This variety keeps the betting experience dynamic and exciting, catering to different interests and risk levels. For instance, during NFL season, popular NFL props include touchdown scorers (anytime, first, last) and rushing yards, while NBA props might focus on three-pointers made or assists.

The explosion of prop markets, especially since the repeal of PASPA in 2018, has made these bets widely available, with sportsbooks offering hundreds of options for major games like the Super Bowl.

Social Interaction and Community Building

Betting on player props often extends beyond individual enjoyment, becoming a social activity that fosters community. Bettors discuss their choices with friends or engage in online forums, Discord’s, and X. For example, betting on Patrick Mahomes to throw over 2.5 touchdowns can spark conversations about his recent form and matchup, enhancing the viewing party atmosphere. This social aspect is particularly evident during big events, where prop bets like the Super Bowl coin toss outcome become topics of friendly wagers.

Potential for Higher Payouts and Risk-Reward Appeal

Certain player props, especially those with longer odds, offer the potential for higher payouts, attracting bettors seeking significant returns. For instance, betting on a long shot like Chris Godwin to score a touchdown at +400 odds can yield substantial profits compared to standard spreads. This risk-reward appeal is particularly enticing for experienced bettors who use detailed analytics to identify undervalued opportunities, such as betting on a player with a favorable matchup.

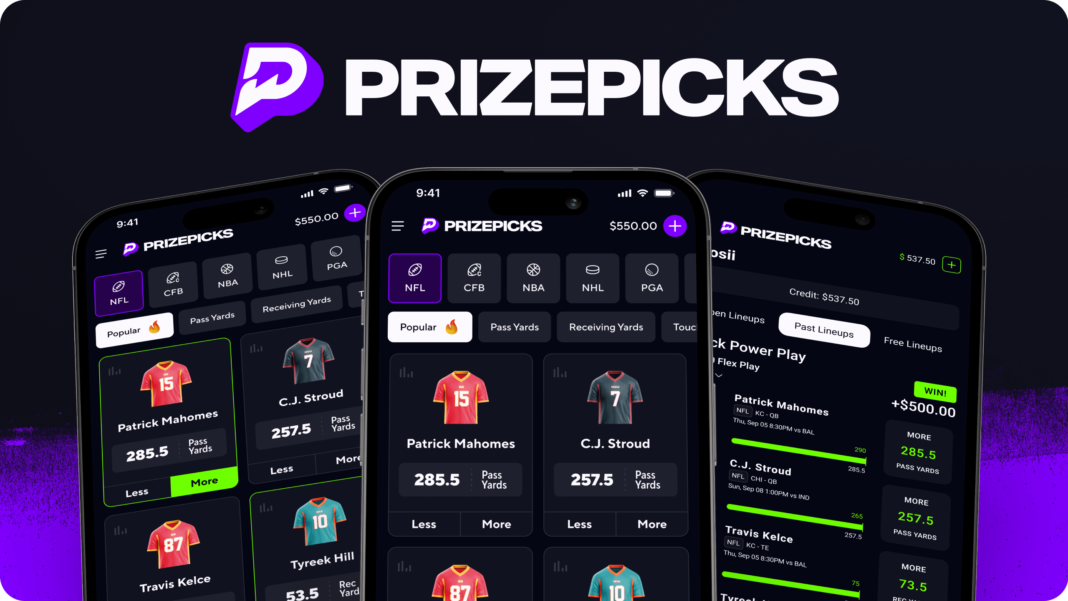

I would be misleading readers if I did not mention DFS 2.0 apps in this specific area of the article. Apps such as PrizePicks and Underdog Fantasy have benefited, potentially more than sportsbooks, from the craze of prop betting. Classified as fantasy products, these DFS 2.0 apps have avoided the legal scrutiny and regulatory costs of gambling platforms.

Playing the same game that FanDuel and DraftKings did from 2011-2018, PrizePicks and Underdog have amassed millions of players while awaiting the eventual enforcement by states to become true real-money gambling platforms.

| DFS 2.0 Apps | App Store Rank (Sports) |

|---|---|

| PrizePicks | 1 |

| Underdog | 4 |

| Sleeper | 28 |

| Dabble | 32 |

| Chalkboard | 43 |

Hedging and Diversification Strategies

Player props serve as a strategic tool for hedging and diversifying bets, managing risk and increasing potential returns. For example, if a bettor has wagered on a team to win but is unsure about their performance, they might bet on a key player from that team to exceed their prop line, offsetting potential losses. This flexibility is particularly valuable in volatile games, where individual performances can still provide payouts regardless of the final score.

Engagement Throughout the Game

Unlike bets on the final outcome, player props keep bettors engaged throughout the game as they track their chosen players’ performances. For instance, betting on Nikola Jokić to grab over 12.5 rebounds means following his every move on the court, adding continuous excitement. This in-game engagement is a key driver of popularity, especially for live betting, where rapid line movements require quick decisions but keep bettors invested. Don’t think for one second that the leagues are not pushing this angle when negotiating deals with TV networks and streaming outlets.

Emerging Trends and Technological Integration

A notable trend is the increasing use of AI tools and advanced analytics to inform player prop betting decisions. Platforms like BettingPros offer reports such as the Player Prop Streaks Report, helping bettors identify hot streaks and trends. This technological integration reflects the sophistication of the market, with bettors leveraging data to gain an edge. Additionally, the rise of player prop betting has attracted a new demographic, expanding the market significantly, particularly in the NFL.

Bettors risked an estimated $150 billion and lost more than $13 billion with U.S. sportsbooks last year, the most since 2018 when legal betting began spreading across the nation, according to the American Gaming Association (AGA). That $13 billion figure is comparable to how much Americans spent on Cyber Monday last November.

httpss://www.espn.com/espn/betting/story/_/id/43956734/sports-betting-industry-facing-major-challenges-growth

📊 Comparative Analysis: Player Props vs. Traditional Bets

To illustrate the appeal, consider the following comparison:

| Aspect | Player Props | Traditional Bets (e.g., Moneyline, Spread) |

|---|---|---|

| Focus | Individual player performance | Team outcome |

| Engagement Level | High, game-long tracking | Lower, focused on final result |

| Predictability | Perceived as more predictable | Often seen as less predictable |

| Variety | High, numerous options | Limited, fewer options |

| Payout Potential | Higher for long odds | Generally lower, more standardized |

| Social Interaction | Encourages discussion, community | Less social, more individualistic |

This table highlights why player props are often preferred for their dynamic and engaging nature compared to traditional bets.

📈 Evidence of Prop Bets Massive Growth Trajectory

Prop bets have surged in popularity due to their appeal to casual and engaged bettors alike, offering a personalized, granular wagering experience. Here’s how this growth manifests within the 2022–2024 window:

- Industry Observations and Market Share:

- Industry experts, including those from the AGA and sportsbook operators like DraftKings and FanDuel, have noted that prop bets, especially player-specific props, have become a cornerstone of modern sports betting. By 2023, estimates from sportsbook analysts suggested that prop bets accounted for 20–30% of the total handle in major markets, with that share growing annually. For context, in 2018, pre-legalization estimates pegged props at under 10% of bets in Nevada, the only legal market at the time.

- During the 2023 NFL season, prop bets reportedly made up over 50% of wagers placed on high-profile games like the Super Bowl, per operator insights shared with outlets like ESPN. For Super Bowl LVIII in 2024, the AGA estimated a record $23.1 billion in total wagers, with operators like Bet365 reporting that player props (e.g., passing yards, touchdowns) dominated betting slips, outpacing traditional moneyline or spread bets.

- Online Platforms Fueling Prop Expansion:

- The shift to online betting (58% of the market by revenue in 2023, per Grand View Research) has turbocharged prop betting. Mobile apps allow sportsbooks to offer hundreds of prop options per game, updated in real-time. For example, FanDuel reported in 2023 that its app saw a 60% year-over-year increase in prop bet volume during the NFL playoffs, a trend likely accelerating into 2024-25 given the handle growth from $119.84 billion to $147.9 billion.

- Micro-betting, a subset of props focusing on in-game moments (e.g., “Will the next play be a run?”), emerged as a fast-growing niche. Companies like Bet365 and DraftKings rolled out extensive micro-betting menus by 2023, with adoption spiking in 2024-25 as live betting handle grew 30% year-over-year in states like Illinois and New Jersey.

- Specific Events and Scandals Highlighting Prop Popularity:

- The 2024 Jontay Porter scandal with the NBA underscored prop betting’s prominence. Porter was banned for life after allegedly manipulating his performance to hit under prop bets (e.g., low points scored), with DraftKings flagging irregular betting patterns. This incident, reported by CNN and others, showed how prop bets had become significant enough to warrant sophisticated monitoring, implying a massive betting volume.

- Super Bowl prop markets have ballooned: In 2022, BetMGM offered around 900 prop options for Super Bowl LVI; by 2024, that number exceeded 1,200 for Super Bowl LVIII, with 70% tied to player or novelty outcomes (e.g., Gatorade color), per operator press releases.

- State-Level Insights:

- In New York, the top market with $2.1 billion in 2024 revenue, regulators noted in 2023 that prop bets on college sports were so popular that they prompted legislative proposals to ban them (e.g., the SAFE Bet Act federally and New Jersey’s state ban). This suggests props were a substantial portion of the $19.7 billion handle in 2023, likely growing into 2024’s $25 billion-plus handle.

- Ohio, launching in 2023, saw prop bets drive early adoption. The Ohio Casino Control Commission reported a $6.8 billion handle in its first year, with operators like Bet365 attributing over 40% of bets to props during the NBA and NFL seasons.

💰 Quantifying the Growth (Best Estimates)

Without nationwide, prop-specific data, we can extrapolate from trends:

- If prop bets were 20–30% of the $93 billion handle in 2022 ($18.6–$27.9 billion), and their share rose to 30–40% of the $147.9 billion handle in 2024 ($44.4–$59.2 billion), the growth in prop betting handle could range from 112% to 138%—far outpacing the overall 59% handle increase. This aligns with operator reports of prop betting doubling or tripling in volume in mature markets like New Jersey from 2022 to 2024.

- Revenue from props likely grew similarly, given their higher hold rates (often 10–15% vs. 7–9% for traditional bets), contributing disproportionately to the 81.3% revenue jump from $7.56 billion to $13.71 billion.

Why Prop Bets Exploded

- Fan Engagement: Props tie betting to individual player narratives, amplified by fantasy sports’ popularity (e.g., DraftKings’ roots in DFS).

- Technology: Real-time data and AI enable sportsbooks to offer dynamic props, especially in-play, which grew from 25% of handle in 2022 to 35% in 2024 in states like Massachusetts.

- Cultural Shift: Younger bettors (under 35), who drove much of the 2024 Super Bowl’s 68 million participants (up 35% from 2023), favor props for their entertainment value, per AGA surveys.